May 2009

An Examination of Luxury Suite Ownership in Professional Sports

- Heather J. Lawrence, Ohio University Center for Sport Administration

- James Kahler, Ohio University Center for Sport Administration

- Ron T. Contorno, Full House Entertainment Database Marketing

This exploratory study in professional sports luxury suite ownership was conducted to provide professionals in suite sales and facility management an increased understanding of the characteristics of corporate luxury suite owners. The business portion of suite client lists were collected and analyzed through a collaborative effort between the Center for Sports Administration at Ohio University, the Association of Luxury Suite Directors, Full House Entertainment Database Marketing, and Turnkey Sports and Entertainment. Strategically selected professional sports franchises and venues within the top 50 media markets nationwide were invited to participate in the research by submitting their luxury suite client lists. Ultimately, 25 markets were represented in the study. The sample of suite owners (n = 2,154) was then analyzed using the master business database from infoUSA to determine the Standard Industrial Classification (SIC) / industry code, sales volume / asset size, business status, and year established of each suite client. Three hundred and forty-three SIC codes were represented by the 1,956 client matches. Overall, 39.4% of all suite owners were represented within the top 10 SIC codes with an additional 11.2% in positions 11-21. The top industry owning luxury suites was banks/ bank holding companies and the second largest SIC was attorneys / legal services. The collaborative effort between academia and industry has provided luxury suite sales professionals and facility managers important information on types and sizes of companies owning luxury suites and has given venues and franchises the ability to assess their own penetration into the top industry and size segments of suite ownership.

Public assembly facilities have included luxury suites since the ancient Greeks and Romans began constructing sport venues and separating spectators by class. Although the objective in ancient times was to provide premium seating for royalty and upper-class citizens, today the objective is to generate revenue. Luxury suite revenue accounts for an average of $9.8 million per professional sports venue annually in the United States (Lawrence, Contorno, Kutz, Hendrickson & Dorsey, 2007). With that amount of money at stake for franchises and venues, it is surprising that very little research has been conducted on the luxury suite industry in professional sports.

The allure of the luxury suite is nothing new in professional sports, but with luxury suites representing the primary source of revenue for most new sports facilities, suite inventory must be sold (Wulf, 1995). Until recently, suite revenue was not included in the National Football League (NFL), National Basketball League (NBA), National Hockey League (NHL), or Major League Baseball (MLB) revenue-sharing agreements (Farrey, 1998; Gallagher, 2000). Some leagues now require portions of 2 suite revenue to be shared, however suite revenues are still a key ingredient of an organization’s financial prosperity. Additionally, many professional sports franchises rely on suite revenue to support debt service obligations from stadium construction or renovation projects.

Database mining (data mining, marketing research, customer analyzation) is one option for any entity looking to target new sales prospects. Database mining can be defined as knowing what your best customers look like. However, in sports, and especially luxury suite sales, database mining has been underutilized. Marketing research allows an organization to create parameters for an “ideal client” based on knowledge of their existing clients or knowledge of clients at other venues. The vast majority of luxury suites are leased to businesses, which is good for teams and venues because corporations spend considerably more per attendee than the average ticket price (Zimbalist, 1992). Because most suite clients are corporate entities, data mining and subsequent direct marketing campaigns (direct mail, sales calls) are natural strategies for teams and venues that need to learn more about their existing clients and fill suite inventory. Based on responses from a 2007 survey, the average number of un-sold suites in a professional sports venue is 7.6, which means that money is being left on the table (Lawrence, Contorno, Kutz, Hendrickson & Dorsey, 2007). Also, as Bill Dorsey, the executive director of the Association of Luxury Suite Directors said, “Premium seats do not sell themselves anymore” (Stone, 2004, p. 1).

The current situation in the New York / New Jersey area demonstrates how database marketing and research might be used. The professional sports franchises in the New York / New Jersey metro area are building five new sports facilities slated to open over the next few years and are expected to charge upwards of $200,000 per luxury suite (DeMarrais, 2006). This is occurring in a market that has not had any new sports venue construction since 1981 (DeMarrais, 2006). The competition among these franchises for luxury suite clients will be great, especially after the facilities have been open a few years and the novelty of the new venue has worn off. Dorsey said, “competition for premium seating in that town (New York / New Jersey) is going to be insane. Nothing like this has ever happened” (DeMarrais, 2006, p. 1). The New Jersey Devils already have boasted that six Manhattan-based businesses have bought suites due to the availability of mass transit from New York — thus allowing the Devils to cross into a market traditionally reserved for New York professional teams (Brennan, 2007). In the example of the New York / New Jersey metro market, marketing research would allow these teams to focus on their best opportunities for new business and cut down on waste by staying away from non-buying industries. These strategies will maximize return on investment opportunity.

Purpose

The purpose of this study was to explore luxury suite ownership in professional sports and to provide suite sales and facility management professionals an increased understanding of luxury suite ownership. Additionally, this research recommends to suite sales professionals how to best utilize database marketing as part of their suite sales strategy. This project was a collaborative effort between the Center for Sports Administration at Ohio University, The Association of Luxury Suite Directors, Full House Entertainment Database Marketing, and Turnkey Sports and Entertainment.

State of the Industry

Luxury suite availability and occupancy are key components of financial success in today’s professional sports. According to a 2002 examination of the economic values of professional sport 3 franchises in the United States, there were 8,090 luxury suites available with the potential for gross revenues over $625.8 million annually (Lee & Chun, 2002). The same study also found that sales of luxury suites can form a significant proportion of overall team revenue; for example, the Dallas Cowboys could generate 22.8% of their total team revenue through the sale of luxury suites if all were sold (Lee & Chun, 2002). Luxury suite availability and stadium lease agreements also can play a role in team relocation. Teams with the ability to leverage for higher percentages of advertising, concessions, and parking revenues are taking advantage of municipalities looking to bring professional sports into the area. During the late 1990s, both Los Angeles-based NFL franchises left the second-largest TV market due largely to luxury suite offerings (Wulf, 1995). The Raiders moved to Oakland, where the number of luxury suites offered increased from 58 to 175; the Rams moved to St. Louis, where the team was promised a new stadium with 120 luxury suites (Wulf, 1995). Additionally, the Rams went from being a stadium tenant and sharing their venue with the Angels to being in complete control of their new facility in St. Louis. Other professional leagues are in a similar situation with financial success determined more and more by suite sales and ancillary revenues.

In the past 20 years, 75% of American sports teams have either built or remodeled their stadiums and arenas with luxury suite additions being one impetus for the construction and renovation (Lewis & Cat Le, 2006). Overall, facility construction costs have escalated at a dramatic pace since the 1950s. According to Siegfried and Zimbalist (2000, p. 97), using constant 2000 dollars, “the average facility construction cost was $3.8 million in the 1950s, $25 million in the 1960s, $71 million in the 1970s, $103 million in the 1980s, and $200 million between 1990 and 1998.” In 2007, construction budgets continue to escalate: The most recent predictions put the spending on the five new venues in the New York / New Jersey market at a total of $5 billion (DeMarrais, 2006). Suites will continue to play a prominent role in new construction because the potential for revenue is great and increased construction costs will require higher debt service payments that can be supported by suite sales.

In 1999, five new arenas opened featuring a total of 440 suites — 379 more suites than the venues they replaced (Cohen, 1999). In 2007, the New Jersey Devils will play in the new Prudential Center, which has 76 of the largest suites in North America (New Jersey Devils, 2007). The Devils previous home at the Continental Arena had only 29 suites (Brennan, 2007). League averages for the numbers of luxury suites available range from a low of 76 in MLB to a high of 143 in the NFL with costs also varying between leagues (Table 1). Siegfried and Zimbalist (2000) predicted 30-year cycles of sport construction from 1990 through 2020 and then beginning again in 2020. If this is prediction proves true, the construction and renovation spending we are seeing today will only increase in the next 10-15 years. New construction will result in increased revenue potential through the increased number of suites available in venues.

New facilities seem to have the easiest time selling luxury suites, but after a few years the novelty wears off. Five and seven-year suite lease agreements are the most common and when suite leases come up for renewal the first time, it is more difficult to get corporations to renew leases (Lawrence, Contoro, Kutz, Hendrickson & Dorsey, 2007). Because corporations want to be affiliated with winning organizations, franchises with successful teams also have greater ability to generate revenue through suite sales and a greater chance of suite renewals. Even in a new stadium, the Cincinnati Bengals had suite holders talking of dropping their suites after the team went 2-14 in 2002 (Peale, 2004). Those suite holders were contractually bound by their leases, but by 2004, the team was able to sell 109 of 112 luxury suites prior to the season (8 more than in 2003) after hiring a new coach and going 8-8 (Peale, 2004). In 1995, Key Arena in Seattle opened its doors and made enough money through luxury suites and club seats to cover its debt for the first three years (Lewis & Cat Le, 2006). Then, the NBA lockout and less-than-stellar performances on the court over the past 10 years led to only 28 of 48 luxury suites being sold for the 2005-06 season (Lewis & Cat Le, 2006). As is the case in Seattle, non-renewal of leases affects the ability of the team and venue to pay off construction debt; and arenas are finding that they may have to resell a suite five or more times over several decades in order to pay off construction loans (Cohen, 1999; Lewis & Cat Le, 2006). The potential re-location of the Seattle Supersonics also centers on team ownership seeking a new venue with increased control of the venue, increased luxury suites and premium seating, and retention of additional revenues.

Amenities in luxury suites are increasing as corporate clients increasingly use the suites more for business functions and less for social reasons. In a 2007, it was found that 61% of teams and venues had over 90% of their luxury suites owned by corporations while another 23% had between 75% and 90% corporate ownership (Lawrence, Contorno, Kutz, Hendrickson & Dorsey). Companies are willing to spend a premium on luxury suites because they provide an optimal environment in which to build relationships and close deals with clients (DeMarrais, 2006). Additionally, corporate luxury suite holders may be able to write off 50 percent of the expense for tax purposes as long as the expense is “directly related” or “associated” with the suite owners business (DeMarrais, 2006; Wulf, 1995). A luxury suite at New York’s Madison Square Garden typically offers 16 seats in the box for every event, a special VIP entrance, a glass-enclosed living room and complimentary waiter service (Wulf, 1995). Access to patios, fireplaces, wine cellars, and balconies overlooking amazing views also part of some suite ownership agreements (Cohen, 1999). Amenities at the new Indianapolis Colts Lucas Oil Stadium will include catered food, three flat-screened TVs per suite, granite countertops, wood paneling, chrome coffee tables and Colts-themed carpet (Smith, 2007). These amenities in combination with the tax write-off and the environment to accomplish business goals all contribute to the willingness of corporations to spend large amounts of money to own a luxury suite.

Methods

Participants

Professional sports teams and venues with professional sports teams as tenants were strategically selected from within the top 50 media markets nationwide. Teams and venues were contacted via telephone and e-mail and asked to participate in the research by submitting their luxury suite client lists. Selection of the sample of teams and venues was based upon existing relationships between teams and the collaborating organizations involved in this project. Only one organization within each market was targeted due to the sensitive nature of the information being requested. In return for their participation, teams received an analysis of their current customers by Standard Industrial Classification (SIC) code / industry and size. Of the 50 teams and venues initially contacted, 33 indicated a willingness to participate and 25 ultimately submitted their suite client list to the researchers, resulting in a 50% participation rate. Nondisclosure agreements were provided to teams and venues requiring confirmation of confidentiality of their submitted suite owner client list.

From the 25 teams and venues, a final sample of 2,154 business owned suites were then analyzed using the master business database from infoUSA. The infoUSA database is one of the most complete directories of United States businesses with over 14 million company records (infoUSA, 2007). This 5 source allowed the researchers to match and add key data elements on to the suite customer file. For the purposes of this study, SIC / industry code, sales volume/asset size, business status, and the year each corporation was established were appended to the customer file.

Procedures

From the 2,154 submitted suite clients, InfoUSA matched 1,956 based on SIC code, establishing a match rate of 90.8%. SIC code information can range from 2-digit to 6-digit breadth of category (with 6-digit providing the most narrow category breadth). For the purposes of this research, the SIC codes were first analyzed at a 6-digit level and then transformed into a 4-digit level to ensure that SIC code categories would contain enough suite clients to adequately analyze the data. The 1,956 client matches represented 343 4-digit SIC codes. The researchers manually checked all of the 4-digit SIC codes returned and corrected obvious mistakes.

It was discovered during analysis that within the 4-digit SIC codes, it was appropriate to combine a few similar categories for analysis based on the product or service provided by the company. Four digit categories combined included a) banks and bank holding companies; b) television broadcasting stations, cable / other pay TV services, radio broadcasting stations, and newspaper publishing / printing; c) telephone communications and radiotelephone communications; and d) beer / ale and wine / distilled alcoholic beverages. In some instances, the broad 2-digit SIC code was the most appropriate level of classification. At the 2-digit SIC code level, general contractors-single family houses and general contractors-nonresidential buildings were both tallied under the 2-digit SIC code of general contractors / home builders. Also at the 2-digit level, security brokers / dealers, commodity contracts brokers / dealers, and investment advice all were categorized under the 2-digit SIC code for finance / investments. Additionally, the category of nonclassified establishment and professional sports clubs and promoters (internal customers) were removed from data analysis. After the removal of the two categories, the final sample size was 1,887.

Sales volume / asset size, business status, and year established were all grouped into ranges and assigned a category label to assist in the analysis. Sales volume / asset size was grouped into a) less than $500,000, b) $500,000 to $1 million, c) $1 million to $2.5 million, d) $2.5 million to $5 million, e) $5 million to $10 million, f) $10 million to $20 million, g) $20 million to $50 million, and h) over $50 million. The sales volume / asset size analysis was focused on only the top 10 SIC codes resulting from the SIC code analysis. Business status refers to headquarters, subsidiary headquarters and branch locations which are all part of a larger organization (“linkage”). InfoUSA then matched 816 (37.9%) of the original 2,154 suite clients on year established. This variable was grouped by the decade the corporation was established (except prior to 1940) and newer companies were categorized as 2000 to present.

Finally, infoUSA database was used to explore the existence of businesses within the same 25 metro markets as the participating teams and venues. This additional data enabled the researchers to examine suite ownership penetration by sales volume into the top 10 business segments. Descriptive statistics were conducted using Excel to explore the prevalence of the SIC /industry code, sales volume / asset size, business status, and year established in suite ownership.

Results

The objective of this study was to provide suite sales professionals and facility managers an increased understanding of luxury suite ownership. To accomplish this objective, descriptive statistics were conducted to analyze SIC codes, sales volume/asset size, and business status.

SIC Codes

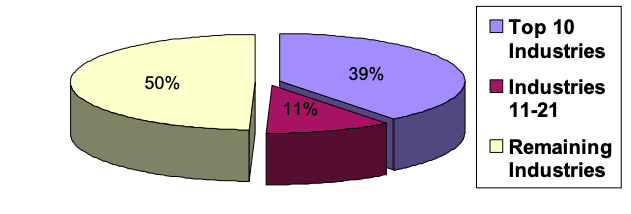

A majority (50.6%) of the 1,887 suite clients were represented in the top 21 SIC codes with 39.4% represented in the top 10 (Table 2). The top 21 SIC codes were used due to a tie in representation in position 20. The remaining suite owners (49.4%) represented the other 322 SIC code categories (Figure 1). With the majority of the suite clients representing the top 21 industries, it was decided to focus on those SIC codes for the purposes of data reporting.

Of the top 21 industries, 77.8% were represented in the top 10. The top three rankings from this study dominate the industries currently owning suites. Banks/bank holding companies represented 131 (6.9%) and attorneys/legal services represented another 129 (6.8%). Television / radio / newspaper came in third with 109 (5.8%) clients. These three categories alone were responsible for 369 of the suite ownership analyzed and 19.6% of the entire data set. When analyzing these top 3 industries as a percentage of the top 10, the results are even more profound, with 49.7% of the top 10 SIC codes represented in three categories. The fourth and fifth rankings also had a high number of suite clients. Insurance (n = 82, 4.4%) and finance / investments (n = 81, 4.3%) accounted for 8.6% of the overall ownership within this study. The cumulative percentages of the top 5 SIC codes totaled 28.2% (n = 532) of total ownership, 55.5% of top 21 ownership, and 71.6% of top 10 ownership. The remaining industries in the top 10 included a) general contractors / home builders (n = 45, 2.4%), b) management consulting services (n = 44, 2.3%), c) accounting / auditing / bookkeeping (n = 44, 2.3%), d) real estate agencies / managers (n = 40, 2.1%), and e) telecommunications (n = 38, 2.0%).

Rankings 11-21 also had categories that were well represented in categories that represent between 0.8% and 1.4% of total suite ownership from this study. Coming in at number 11 were beer / ale / wine / liquor distributors representing 27 (1.3%) owned suites. Car dealers (n = 25, 1.3%), doctors offices (n = 21, 1.3%), casinos (n = 21, 1.1%), and business services (n = 19, 1.0%) rounded out the top 15 SIC code categories. Mortgage brokers (n = 19, 1.0%), real estate developers (n = 17, 0.9%), and restaurants/caterers (n = 17, 0.9%) also were in the top 21. Finally, ranking in spots 19, 20, and 21 were holding companies (n = 16, 0.8%), title companies (n = 15, 0.8%), and plumbing / heating / air conditioning contractors (n = 15, 0.8%). Overall, rankings 11 though 21 accounted for 11.2% (212) of total ownership within this sample.

The researchers also examined manufacturing categories as a separate entity by using broader 2- digit SIC codes. Within manufacturing, food / beverage products had the highest representation with 58 suites. Industrial / commercial machinery (36), printers / publishers (25), fabricated metal products (24), chemicals / allied products (22), electronics / electrical equipment (17), and measuring / analyzing instruments (17) also were well represented. Some unique categories were also uncovered. Colleges and universities (5), furniture stores (4), dairy products (3), car rental agencies (3), and dog and cat food (2) all were found to own suites within the 25 markets under investigation.

The results of the SIC code analysis clearly demonstrates the dominance of specific industries within suite ownership. The top 10 industries represented 39.3% (743) of total ownership in this study with rankings 11-21 accounting for an additional 11.2% (212). Although the variety of SIC codes represented was large overall, the concentration in the top 21 industries was evident with banks / bank holding companies, attorneys / legal services, and television / radio / newspaper, representing 38.6% of the top 21 industries.

Sales Volume / Asset Size

With respect to sales volume / asset size, the top 10 markets were analyzed using descriptive analysis (Table 3). Of the 743 suite owners represented in the top 10 SIC codes, infoUSA was able to match 581 (78.2%) with respect to sales volume/asset size. Of the top 10 industries, banks / bank holding companies was the only category in which infoUSA uses asset size instead of annual sales volume to classify this variable. Additionally, corporate asset size (instead of local) was utilized for banks / bank holding companies because a large majority of this industry is structured as a corporate office owning the suite. InfoUSA generates sales volume / asset size data for attorneys / legal services per attorney (instead of per firm). For all other categories, the local sales volume was used for analysis.

The largest sales volume / asset size category was the grouping of corporations over $50 million (n = 189, 32.5%). However, this can be explained by the fact that 97 banks / bank holding companies were represented in this category as having over $50 million in assets. Seventy-one of the corporations were categorized with sales volume / asset size of $20 million to $50 million; this group included only one bank / bank holding company and had many of the other top 10 industries represented. Sixty-four (11.0%) were categorized as $1 million to $2.5 million, 58 (10.0%) were categorized as $500,000 to $1 million, 51 (8.8%) were categorized as $5 million to $10 million, 46 (7.9%) were categorized as $10 million to $20 million, and 39 (6.7%) were categorized as $2.5 million to $5 million. Only 13 (2.2%) corporations had sales a volume / asset size of less than $500,000.

Banks / bank holding companies skewed towards the greatest asset size. Ninety-seven (88.2%) of them had over $50 million in assets — the largest size class. Television / radio / newspaper also was strongly represented in the higher sales volume categories. Of the 74 known sales volume classifications for television / radio / newspaper, 14 (18.9%) were in $10 million to $20 million, 14 (18.9%) were in $20 million to $50 million, and 24 (32.4%) were over $50 million. On the other hand, the matched attorneys / legal services were skewed towards the low end with 50 (49.5%) in the category of less than $500,000. For the attorney category, infoUSA reports sales revenue per attorney instead of per firm, which could explain this finding. Other SIC codes were distributed equitably across the sales volume categories, with the exception of the less than $500,000 category which had few suite owners within the group. Overall results indicate that the majority of corporations owning suites are represented in the upper levels of sales volume / asset size.

Market Penetration

The top 10 industry segments were also analyzed based on market penetration. To establish the universe of prospects, the top 10 SIC codes were used to search the infoUSA database in the same 25 markets. The universe of prospects generated within the top 10 industries was 441,955. The greatest market penetration was found in the category of television / radio / newspaper where results indicated that 8 of the 6,111 corporations in this grouping, 109 owned suites for a market penetration of 1.8%. The universe of prospects for banks / bank holding companies totaled 24,781; the study data indicated 131 suites owners within this category for a market penetration of 0.5%. Other SIC codes above 0.2% market penetration included finance/investments (universe of prospects, 33,650; suite ownership, 81; market penetration, 0.24%) and telecommunications (universe of prospects, 14,377; suite ownership, 38; market penetration, 0.26%).

The universe of prospects was then categorized based on sales volume. Of the 441,955 SIC code matches, 19,103 (4.3%) had an unknown sales volume / asset size. Overall, the total number of top 10 SIC codes with matched sales volumes / asset size in the 25 markets was 422,852. Banks / bank holding companies were removed from analysis because infoUSA reports asset size instead of annual sales volume for this category. A new universe of prospects was established of 415,774 after removing banks / bank holding companies (24,781) and unknown sales/volume asset size (1,400). A new sample of 471 top 10 SIC codes was also established after removing banks / bank holding companies (131) and unknown sales / volume asset size (141). Overall, a large portion (186,104, 44.8%) of the matched universe of prospects fell into the less than $500,000 category compared to only 13 (2.7%) of the suite owners. The second largest category for the universe of prospects was $500,000 to $1 million with 102,430 matches representing 24.6% of the prospect universe. Within the sample, 57 suites were owned by corporations in this category resulting in a market penetration of 0.06%. The greatest market penetration was found in those corporations with sales volume/asset size over $50 million. The universe of prospects was 1,597 (0.4%) and there were 92 (19.5%) suite owners in this category for a market penetration of (5.8%). Nationally, there are fewer corporations in the upper revenue groups which may account for the greater market penetration. There is also some success in market penetration in the $20 million to $50 million category. Of the 2,870 prospects with sales volume / asset size between $20 million and $50 million, 70 currently own suites for a 2.4% market penetration rate. From this data, it is apparent that teams and venues are having the greatest success selling suites to companies occupying the larger sales volume categories.

Business Status

The researchers also investigated records with “linkage”, which is defined as those corporations considered headquarters, subsidiary headquarters, or branch locations of a larger organization. Corporations not meeting this definition are considered independent. Linkage is an important variable in suite ownership because teams or venues seeking to use database mining may look to prospect based on this variable. Of the original 1,956 suite clients, 954 (48.8%) companies were matched as having linkage. In the master infoUSA database of 14 million companies, only 11% of the businesses demonstrate linkage. Thus, suite buyers seem to be more likely to demonstrate linkage than the general corporate population.

Discussion

The second research object of this study is to recommend to suite sales professionals how to best utilize database mining as part of their suite sales strategy. With suite ownership heavily weighted in the top 10 SIC codes, those industries will be the focus of discussion. Knowledge of the top industries represented by suite ownership is essential information for a sales staff trying to increase suite occupancy. Not only is knowledge of national trends in ownership important, but also an understanding of current suite ownership in the venue is vital. The ability to quantify success should be the foundation of strategies employed in suite sales. Database mining and targeted direct marketing campaigns assist sales professionals in achieving this goal.

SIC Code Strategies

In the broadest sense, a team or venue might use these results to discern the approximate average number of suites that should be owned by a particular business category. Averages can be determined by dividing suite ownership rates by SIC code, then by the 25 markets that participated in the study so that averages can be determined. For example, 131 attorneys / legal services were represented in this study. By dividing 131 by the 25 markets, an average per team or venue ownership is established of five attorneys / legal service suite owners. Although markets vary greatly, this approach might give a simple perspective to a team or venue looking to produce some general comparisons to other markets. This also can be a first-step before more complicated database marketing techniques are used.

The top 3 rankings for SIC code dominate overall suite ownership with the next 7 categories also having high representation. Teams and venues with limited sales resources (staff, budgets, etc.) might choose to target a few business segments based on the greatest possibility of success. Businesses in the top 3 SIC codes from this study represented 19.6% of suite ownership. Targeting resources at a focused segment of businesses through database marketing is a simple straightforward way to use the research data. Success can easily be measured by the number of successful sales occurring within the targeted SIC code categories.

Another way a sales staff could use the SIC code information is to compare the industry segments of their current owners with the results of this research. This strategy would enable targeted sales campaigns based on knowledge of current ownership. Data from this study shows that insurance is a top business segment in suite ownership. So, if a team or venue discovers that they have no suite clients in the insurance industry, future marketing efforts can be directed toward this underrepresented category. Success measurement using this approach also is quite simple as documentation of new customers within the underrepresented targeted industries would indicate a successful campaign.

Market Penetration Strategies

Market penetration can be measured using multiple variables. In this study, the first measure compared the top 10 SIC codes with the universe of prospects in the same 25 markets under investigation. Limited penetration was found by SIC code, with the highest penetration rate in the category of television / radio / newspaper (1.8%). This category is unique because many professional sports franchises use trade or sponsorship agreements instead of strictly selling suites to these industry segments. According to Bill Dorsey, executive director of the Association of Luxury Suite Directors, this trend is becoming less common because sponsorship of supply deals diminish the value of the suite (DeMarrais, 2006). The second highest penetration rate was in the category of attorneys / legal services. Of the 24,781 within the universe of prospects, 131 were found to own suites, indicating a market penetration of 0.5%. Accomplishing an overall 1% penetration would result in 247 suites owned by attorneys / legal services or an average of 10 per market. Attaining a goal of 2.5% penetration in this industry would result in a total of 619 suites owned by this industry within the 25 markets with an average of almost 25 per venue.

Based on the market penetration data by SIC code, it is apparent that there is room for growth in ownership within the top 10 SIC codes. The insurance industry has the most potential for growth: Only 82 insurance corporations from a universe of 58,296 prospects were found to currently own suites, indicating a penetration of only 0.1%. Accomplishing even 1% penetration (throughout the 25 markets) would result in an additional 500 insurance corporations becoming suite owners or an average of 20 new suite clients per market. Establishing organizational goals such as doubling or tripling existing market penetration within specific industry categories are measurable, targeted, and realistic.

Prospecting and targeting potential clients becomes more complicated when additional variables are included in the sales approach. Adding sales volume / asset size of top SIC codes creates additional categories of existing and potential customers, but also creates more focused groupings of potential suite owners. Sales volume / asset size information also can be used for informational purposes for the suite sales staff and not necessarily used strategically to narrow client prospects. Using the top 10 SIC codes from this research, corporations were broken into eight sales volume / asset size groupings. Database mining could be accomplished by examining top industries within a certain sales volume/asset size. For example, potential clients could be defined as corporations with an annual sales volume / asset size of between $20 million and $50 million. Then, sales targeting would focus on corporations within the top 10 SIC codes and within the $20 million to $50 million range.

Market penetration also can be a parameter to measure success within sales volume/asset size and can be used to set sales goals within the organization. To most people, a market penetration of 5.8% (as seen with sales volume/asset size category of $50 million and greater within the top 10 SIC codes) may not seem like a good result. Comparing the market penetration of 0.03% in the combined sales volume / asset size categories under $1 million puts the 5.8% penetration into perspective. Market penetrations into the upper sales volume / asset size categories are greater than penetration into the lower sales volume / asset size categories or by any single SIC code. One significant factor that plays a role in these results is the smaller total number of prospects within the higher financial groups. However, this is still positive news for suite sales professionals since it provides one criteria to possibly narrow prospective clients lists.

One approach to setting sales goals for suite sales could involve penetration into known SIC code categories or sales volume/asset size categories. For example, a team using database mining to gather sales leads could first analyze the top SIC codes within their current ownership and divide clients into sales volume / asset size categories. Then, using the results from this study, sales goals could be set for market penetration by SIC code and sales volume / asset size. If a team found that their own penetration within their market in the over $50 million category is only 2% within their top categories, a goal could be set to increase penetration to 5% or 6%. An added benefit of targeting corporations in the largest category of revenue is that it could be assumed they have a larger budget for client entrainment. Sales staff also can confirm, based on this research, that their competitors within the same sales volume/asset size category are using luxury suites to entertain clients and reward their employees.

Potential suite customers also will be interested in sales presentations that are data driven. The information contained in this study provides data to suite sales professionals to further enhance their targeted sales pitches and collateral materials. The ability of suite sales professionals to pitch to a bank armed with data showing that banks represent the greatest business segment in suite ownership is a sizable selling point as well as a confidence booster for the sales representative.

Business Status

Corporations with the characteristic of a headquarters, subsidiary headquarters, or branch location are considered to demonstrate linkage. All other corporations are considered independent companies. Suite ownership is unique in the sense that luxury suite owners in this study were 4.4 times more likely to exhibit linkage than the general business population in the United States. This variable also can be used to narrow client lists, gain client information, or target segments within SIC code categories.

Limitations

This study is limited in few areas. First, secondary data presents an inherent risk of inaccuracies within the data source. Secondary data in this study was collected from teams and venues in the form of suite client lists and was used with the master database of infoUSA. It is likely there are some inaccuracies in the suite client lists submitted and the data from infoUSA. To help counteract this possibility, the researchers manually checked the SIC codes returned from infoUSA and repaired obvious mistakes.

The suite client lists represented teams in all four major professional leagues and various venues with professional teams as tenants. However, only one team or venue was contacted in each market. Markets with multiple teams may have had differences in SIC code penetration based on the prevalence of teams in their market and competition between organizations for suite owners. The researchers believe that seeking client lists from multiple teams and venues in the same market would have restricted participation due to concern over confidentiality of suite client lists. Finally, due to the method of obtaining the sample, it is possible that the sample may not be representative of suite ownership throughout all of professional sport.

Future Directions and Final Recommendations

This study sought to provide information on the status of luxury suite ownership in professional sports to suite sales and facility management professionals. Suggested strategies also were explained based on the results to assist teams and venues as they seek to generate as much revenue as possible for their organizations. There are many research possibilities as an extension of this topic. A logical next step is an examination and measurement of the success of organizations utilizing database mining. Additionally, case study analyses (from the organization and composition of the sales team to sales techniques and prospecting of clients) of organizations executing suite sales campaigns also would contribute to the body of literature on suite sales. The researchers hope that an expansion of this project will be repeated biannually. A longitudinal perspective would enable academics and industry professionals to assess trends in suite ownership and monitor the luxury suite industry as it evolves over time.

Finally, the researchers have four recommendations for the suite industry. First, teams and venues should conduct the necessary research to understand their current suite ownership and then 12 increase their market penetration within the top industries. Second, teams and venues should carefully examine industries that rank high across the country (in this case, from within the 25 markets) to compare and contrast with their current suite ownership. Third, many small businesses display characteristics that are consistent with suite ownership, such as high profit margins and linkage. Small business should not be discounted as prospects until all the information about them is known. Fourth, teams and venues should try data mining and direct marketing campaigns as part of their suite sales strategy to confirm that it works.

References

Brennan, J. (2007, May 3). Owner expects devils to be hot ticket. The (New Jersey) Record. Retrieved June 29, 2007 from www.northjersey.com (no longer available).

Cohen, W. (1999). Oysters, scotch and hoops. U.S. News & World Report, 127(19), 92. DeMarrais, K. G. (2006, December 17). Companies want a piece of the action at new sports venues. The (New Jersey) Record, Retrieved June 27, 2007 from www.northjersey.com (no longer available).

Farrey, T. (1998). Too much of a good thing? Business Week, 3577, 69-70. Retrieved June 27, 2007, from Academic Search Complete database.

Gallagher, J. (2000, May 28). Without new stadium, Lamping fears team will slump, lose fans. St. Louis Post-Dispatch. Retrieved June 25, from Americas Newspapers database. InfoUSA. (2007). InfoUSA [electronic database]. Retrieved June 26, 2007, from www.infousa.com.

Lawrence H. J., Contorno, R. T., Kutz, E., Hendrickson, H. & Dorsey, W. (2007). [Premium seating survey]. Unpublished raw survey data.

Lee, S., & Chun, H. (2002). Economic values of professional sport franchises in the United States. The Sport Journal, 5(2). Retrieved June 22, 2007 from thesportjournal.org.

Lewis, M. & Cat Le, C. (2006, May 15). Nothin’ but profit: Winning no longer key to new NBA. Seattle Post Intelligencer. Retrieved June 25, 2007, from www.seattlepi.com.

New Jersey Devils. (2007). Prudential Center Facility Brochure. Retrieved June 28, 2007 from www.nhl.com/devils.

Peale, C. (2004, July 18). As team turns corner, hopes and sales soar. The Cincinnati Inquirer. Retrieved June 23, 2007, from bengals.enquirer.com (no longer available).

Revenues from Sports Venues. (n.d.). Luxury suites. Retrieved June 26, 2007, from sportsvenues.com (no longer available).

Siegfried, J., & Zimbalist, A. (2000). The economics of sport facilities and their communities. The Journal of Economic Perspectives, 14(3), 95-114. Retrieved June 24, 2007, from www.aeaweb.org.

Smith, E. D. (2007, February 1). Suite Success. Indianapolis Star. Retrieved June 27, 2007 from www.indystar.com (no longer available.)

Stone, D. (2004, January 7). Best seats in the house [Electron version]. Stadia. Retrieved May 16, 2007, from www.stadia.tv/archive (no longer available).

Wulf, S. (1995). How suite it isn’t. Time, 146(2), 52.

Zimbalist, A. S. (1992). Baseball and billions: A probing look inside the big business of our national pastime. New York: Basic Books.

Table 1 - Average Number of Luxury Suites and Pricing by Professional Sports League

| League | Average Quantity | Average Low | Average High | Keywords (hidden column) |

|---|---|---|---|---|

| Major League Baseball | 76 | $99,203 | $190,764 | tag 1, tag2 |

| National Football League | 143 | $62,338 | $195,933 | |

| National Basketball League | 88 | $135,900 | $246,236 | |

| National Hockey League | 94 | $118,451 | $230,133 |

Note: Data retrieved from Revenues from Sports Venues

Table 2 - Suite Ownership by SIC Code Rank

| Rank | SIC Code | Count | Percentage of Total | Cumulative Percentage of Total | Percentage of Top 21 SIC Codes | Cumulative Percentage of Top 21 SIC Codes | Percentage of Top 10 SIC Codes | Cumulative Percentage of Top 10 SIC Codes | Keywords (hidden column) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Banks/Bank Holding Companies | 131 | 6.94 | 6.94 | 13.72 | 13.72 | 17.63 | 17.63 | tag 1, tag2 |

| 2 | Attorneys/Legal Services | 129 | 6.84 | 13.78 | 13.51 | 27.23 | 17.36 | 34.99 | |

| 3 | Television/Radio/Newspaper | 109 | 5.78 | 19.55 | 11.41 | 38.64 | 14.67 | 49.66 | |

| 4 | Insurance | 82 | 4.35 | 23.90 | 8.59 | 47.23 | 11.04 | 60.70 | |

| 5 | Finance/Investments/General Contractors/ | 81 | 4.29 | 28.19 | 8.48 | 55.71 | 10.90 | 71.60 | |

| 6 | Home Builders | 45 | 2.38 | 30.58 | 4.71 | 60.42 | 6.06 | 77.66 | |

| 7 | Management Consulting Services | 44 | 2.33 | 32.91 | 4.61 | 65.03 | 5.92 | 83.58 | |

| 8 | Accounting/Auditing/Bookkeeping | 44 | 2.33 | 35.24 | 4.61 | 69.63 | 5.92 | 89.50 | |

| 9 | Real Estate Agencies/Managers | 40 | 2.12 | 37.36 | 4.19 | 73.82 | 5.38 | 94.89 | |

| 10 | Telecommunications | 38 | 2.01 | 39.37 | 3.98 | 77.80 | 5.11 | 100.00 | |

| 11 | Beer/Ale/Wine/Liquor Distributors | 27 | 1.43 | 40.81 | 2.83 | 80.63 | |||

| 12 | Car Dealers | 25 | 1.32 | 42.13 | 2.62 | 83.25 | |||

| 13 | Doctors Offices | 21 | 1.11 | 43.24 | 2.20 | 85.45 | |||

| 14 | Casinos | 21 | 1.11 | 44.36 | 2.20 | 87.64 | |||

| 15 | Business Services NEC | 19 | 1.01 | 45.36 | 1.99 | 89.63 | |||

| 16 | Mortgage Brokers | 19 | 1.01 | 46.37 | 1.99 | 91.62 | |||

| 17 | Real Estate Developers | 17 | 0.90 | 47.27 | 1.78 | 93.40 | |||

| 18 | Restaurants/Caterers | 17 | 0.90 | 48.17 | 1.78 | 95.18 | |||

| 19 | Holding Companies | 16 | 0.85 | 49.02 | 1.68 | 96.86 | |||

| 20 | Title Companies | 15 | 0.79 | 49.8 | 1.57 | 98.43 | |||

| 21 | Plumbing/Heating/Air Conditioning Contractors | 15 | 0.79 | 50.61 | 1.57 | 100.00 |

Top 10 Suite Ownership Categories with Sales Volume/Asset Size Breakdown

Sales Volume/Asset Size

| SIC Code | SIC Code | Owners | Unknown | Less Than $500,000 | $500,000 - $1 million | $1million - $2.5 million | $2.5 million - $5 million | $5 million - $10 million | $10 million - $20 million | $20 million - $50 million | Over $50 million |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Banks/Bank Holding Companies | 131 | 21 | 0 | 1 | 6 | 1 | 4 | 0 | 1 | 97 |

| 2 | Attorneys/Legal Services | 129 | 28 | 50 | 11 | 5 | 11 | 5 | 7 | 8 | 4 |

| 3 | Television/Radio/ Newspaper | 109 | 35 | 0 | 7 | 6 | 1 | 8 | 14 | 14 | 24 |

| 4 | Insurance | 82 | 22 | 4 | 16 | 4 | 4 | 4 | 6 | 10 | 12 |

| 5 | Finance/Investments | 81 | 18 | 1 | 6 | 19 | 3 | 11 | 4 | 10 | 9 |

| 6 | General Contractors/ Home Builders | 45 | 7 | 0 | 1 | 7 | 1 | 3 | 9 | 9 | 8 |

| 7 | Management Consulting Services | 44 | 12 | 2 | 4 | 5 | 2 | 2 | 5 | 2 | 10 |

| 8 | Accounting/ Auditing/ Bookkeeping | 44 | 5 | 5 | 2 | 2 | 2 | 5 | 0 | 10 | 13 |

| 9 | Real Estate Agencies/Managers | 40 | 7 | 1 | 8 | 5 | 4 | 8 | 1 | 4 | 2 |

| 10 | Telecommunication |

38 |

7 | 0 | 2 | 5 | 10 | 1 | 0 | 3 | 10 |

| Total | 743 | 162 | 13 | 58 | 64 | 39 | 51 | 46 | 71 | 189 |

Note: Sales volume/asset size figures for banks/bank holding companies are based on a combination of local and corporate sales volume, while the other categories are based on local sales volume.

Suite Ownership by Industry

Figure 1. Recognition is given to members of the research team: Bill Dorsey, Association of Luxury Suite Directors; Haynes Hendrickson and Elana Kutz, Turnkey Sports and Entertainment; and, Ohio University students Jennifer Begg, Matt Bixenstine, Nate DeMercurio, Michelle Fogle, Josh Hafer and Karen Rickard.